Tax Time!

It’s tax time!

Did your blood pressure increase a little bit when you just read that? Most people I know utter a little “ugh” when this topic comes up. As is turns out, the concept of taxation isn’t actually all that bad!

Yep, we encounter taxes on so many levels and it can feel like a burden, especially since paying them is enforced by laws with associated penalties. But I’m not here to argue about ideal levels of taxation, who should pay how much, or paperwork and loopholes. I want to discuss civic responsibility and interconnectedness.

When unemployed people experiencing poverty connect to opportunities to contribute to our common tax base, they’re not only contributing to everyone else’s quality of life, they receive the advantage of being further interwoven into the fabric of our collective civic participation. The act of paying taxes builds community!

“We’re all in this together…”

Recently, I’ve been teaching my eight-year-old son about the idea of civic engagement. We’ve been chewing over elements like voting, volunteerism, and, yes, paying taxes. I shared that whether it’s always apparent to us or not, we’re all in this together. I suggested that when people are presented with an opportunity to do something good for other people in a way that is clear and mutual, they’ll do it. My hope for him is that he understands that civic engagement’s combination of societal expectation and free will is not pure obligation, but that it’s actually beneficial to his happiness and well-being – perhaps even instrumental to it.

Staying informed and working with others are also necessary ingredients of a vibrant and healthy democracy. When we work together to ensure that our economy actively includes people at a rate outpacing its exclusion of them, we grow the pie together with more and more contributors. We share in the rewards as much as we share the burden. No matter the differences between us all, we are the same in that, when we pay taxes, we fund schools, services, and infrastructure. Each contributor also gains self-oriented value by being or becoming a contributor. This increases awareness of others, interaction with them, and manifests itself in the mental and emotional health benefits of increased social involvement.

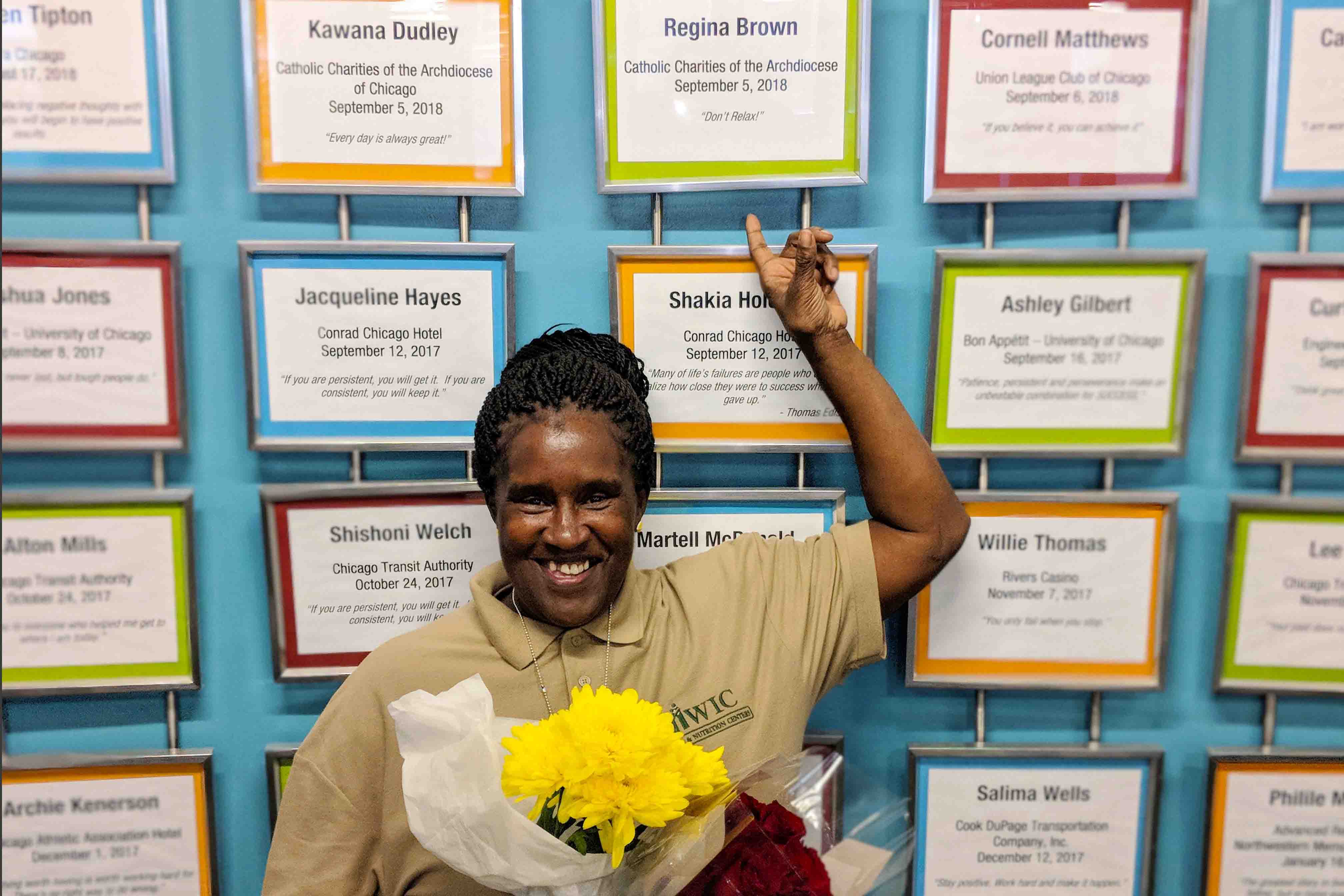

Regina lived most of her life on public benefits – but came to Cara wanting to contribute to society. “All I wanted was to work!”

The right of self-determination

Self-sufficiency is a state of being, but self-determination is a right. In other words, the ability to earn enough to put food on the table is a condition that may be a reality one day, and — oftentimes due to unforeseen circumstances — the next day maybe it’s not. The quality of self-determination, on the other hand, endures once it’s built up. Self-determination doesn’t exist completely contained within an individual.

Think of how many parents, mentors, and role models may have influenced your own sense that the choices you make can shape a better future. Contrary to the connotation, self-determination may actually be collectively built up in this society in which we can interact, engage, and share – a society in which we can all thrive.

At Cara, a major component of our supportive services and coaching for our community is financial literacy, and support in filing taxes. We achieve this with full-time staff as well as partnerships with LISC (Local Initiatives Support Corporation) and other organizations who are involved in financial capability and tax preparation like Center for Economic Progress and Ladder Up.

This component is really about learning. I’ve been involved in many a coaching relationship where the initial sting of the loss of any public benefit income at the start of a new job inevitably transformed to an even more robust monthly household budget that allowed for more choice, more stability, and more integration into the financial mainstream. Navigating these moments involved having some faith, staying committed to seeing things through, and being open to learning more about how one relates to the larger economy.

Shifting the narrative

My experience is that this isn’t just conceptual. People really want this. From filing taxes for the first time to increased sales tax contributions as a more vibrant consumer, the choice to participate in the economy offers an empowering education. If we can shift perspectives around finances to where money is a tool and not simply something to snatch up and hoard, we foster self-determination. If the notion of paying taxes shifts from a duty to a right, we win as a community. We strengthen the structural integrity of our society.

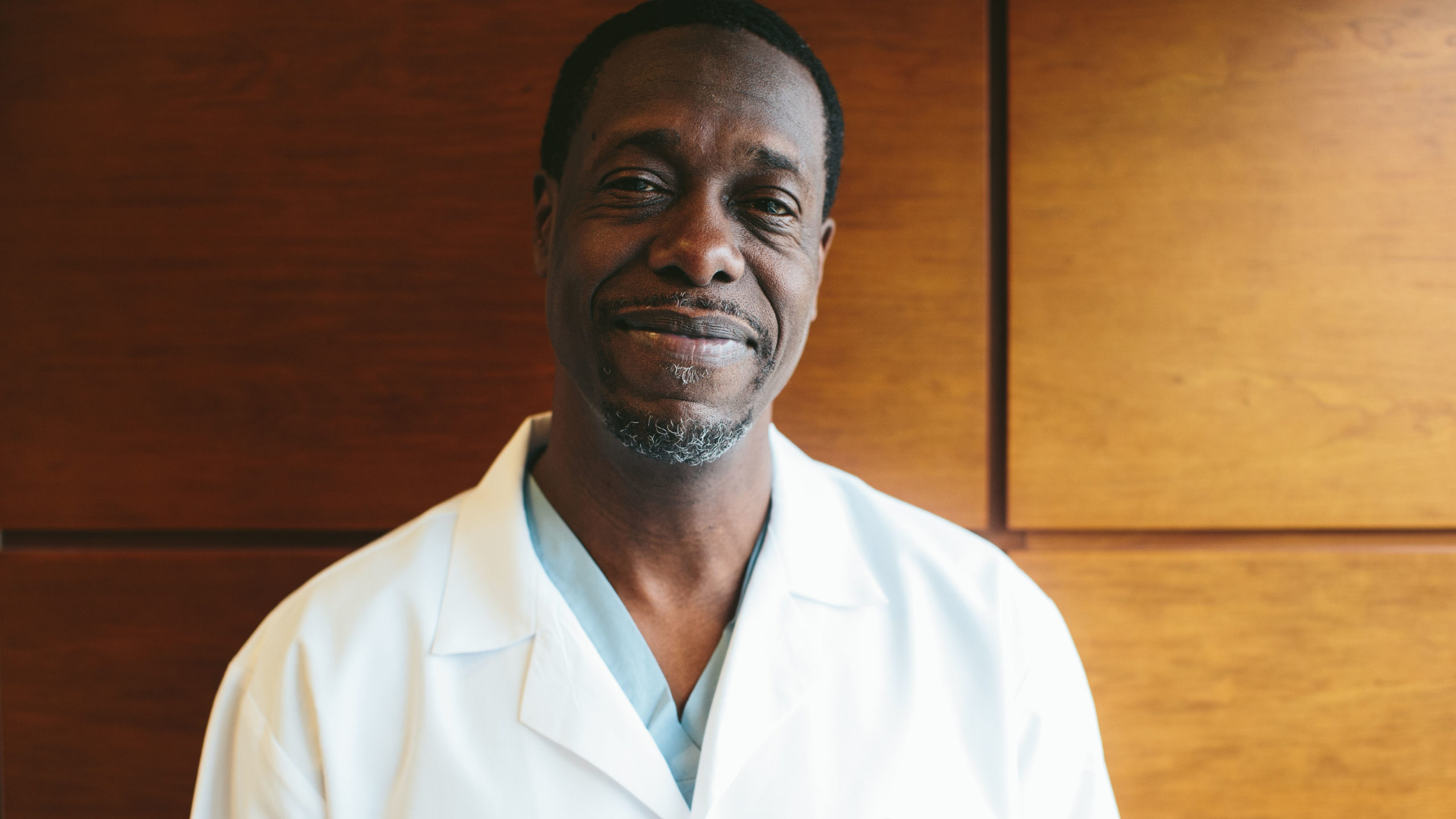

Bob White is the Chief Program Officer of Cara and has worked for the organization for 12 years. A graduate of the University of Michigan, Bob served as the owner-operator of an automotive aftermarket business before entering the non-profit world.